Photo by Kelly Sikkema on Unsplash

Legacy income teams have immense power and responsibility when it comes to maximising the entitlement from each bequest. Blerta Clubb, Solicitor & Senior Legacy Case Manager at Save the Children and speaker at the Excellence in Legacy Administration conference 2018, explains how teams can achieve fantastic return on investment…

Investing in our legacy teams can only bring improved returns, which will enable us to achieve the aims and objectives of those with whom we work with and allow us to effectively promote our respective causes. It will also enable us to focus our time and appreciation on potential supporters to help create future legacies.

From my recent conversations with peers across the sector, some of them have already started to receive investment and they are confident that their incomes will increase as they look to improve their team’s knowledge of legacy matters. It is important that we find the right support for our teams to help them deal with an increased caseload and complex matters.

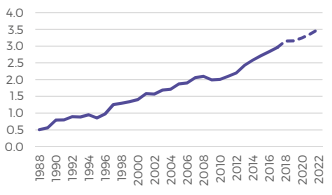

Income is growing and will continue to do so

Legacy income is currently the highest on record (worth an estimated £2.9bn annually) and it is encouraging that market predictions anticipate that legacy income will reach £3.5bn by 2022.

Total UK legacy income (£bn) 1988 - 2022

| Total number of charity bequests (000s) 1988 - 2022 *Legacy Foresight |

Gifts in Wills are a vital source of income for the majority of charities (and is the fastest growing source of income for many). A rise in death rates has resulted in an increase in the number of Smee & Ford notifications, which has also contributed to this growth in income.

The number of disputes arising over charitable gifts in Wills has also risen. Figures reported by The Independent in 2013 showed a 700% increase in the number of actions launched at the High Court to challenge the provisions made in Wills. The reasons behind this increase remain the same today and it is worth noting that these figures do not include the vast number of cases that are settled out of court. As a result, the number of contested legacy cases is also expected to continue to rise.

As well as ensuring that a charity receives its proper entitlement, it is also the legacy team’s duty to ensure that the legacy, as well as the charity’s reputation, is properly protected if and when these challenges arise. The tone and the approach we take can have great consequences in relation to income, as well as reputation.

As this will have an impact on the actual income delivered, we need to ensure that these teams are future-proofed, feel supported and are sufficiently resourced in order to be able to effectively manage this anticipated increase in their caseloads. This will also allow individuals to be more effective in providing added value, which in itself indirectly leads to more income.

The team can help minimise risk while maximising income

In most charities, the legacy income team has a delegated authority (or some form of authority) from their board of trustees, which allows them to fulfil their charity’s obligations, as well as providing them with the ability to maximise the entitlement from each legacy without delay. This immense power and responsibility is often forgotten and provides a legacy team with the opportunity to put themselves in the shoes of the trustees, particularly where there is a potential concern over adverse publicity.

Our legacy teams are full of individuals, with or without legal qualifications, who consider important decisions on a daily basis and whose ability to discern when to raise queries, instruct a legal advisor or refer a matter ‘up the chain’ is invaluable. It is essential that those who have such a responsibility are properly supported and resourced.

Developed teams can improve their return on investment

Developing and enhancing skills within a team can lead to a thriving, more productive and professional team. Qualifications such as CICLA, STEP and CILEx will only better an individual’s knowledge and skill set, which in return will allow them to feel empowered and confident to effectively manage cases. It is inevitable that this will lead to a better income-stream, as well as added value.

Whether be it through training, workshop sessions, or something else tailored to your team’s needs, do not be afraid to have conversations within your team and with your managers about the need for continual improvement. We have some great solicitors/surveyors within the sector and it is as important to also embrace and enhance these relationships.

Collaborating with existing corporate members (solicitors/surveyors) of the ILM and developing new relationships could be a great way to keep up to date with the law. It will also teach us how to approach the practical challenges that arise in our day to day casework. With the often-unrestricted nature of gifts, we need to have the courage to invest in our legacy income teams, so that they can continue to drive their fantastic return on investment.

Here are 5 ways to achieve this:

- Make the most of cross-team collaboration (internally and externally)

- Increase team knowledge and understanding (further qualifications or varying case work)

- Raise team profile to improve understanding and awareness of the team’s responsibilities

- Be efficient with administrative tasks to allow case handlers to focus on their cases

- Be flexible with the team structure to allow for career development and reduce potential flight risks

To be responsive to the income growth, teams must adapt and this can only happen if they are given proper investment and support. When investing in legacy marketing or in other areas of your charity, please don’t forget your legacy income team.

Blerta will be speaking at the Excellence in Legacy Administration conference on how to get internal buy-in, support and recognition for legacy administration. The event will take place on 4 December, in London. To find out more and to book your place, click here.

*Legacy Foresight

*Legacy Foresight